Imagine this: You have a brilliant business idea. You scribble it down and get to the research immediately. Once you have identified competitors and completed the market research, you decide it is time to reach the right investors with a compelling plan.

You are all flared up to start a business requirement document. But that is when a question like “how do I start writing?” becomes the roadblock.

This is not just a challenge you face alone; many with the same flare to start a business are subject to the same bottleneck.

The question is, “How do you start building a business plan without a hitch?”

It is simple, you need an outline that helps you create a business plan in the most engaging way possible for investors. To help you create your business plan outline, we’ve laid a few steps.

But first, let’s understand what it is and why you need to have a business plan outline.

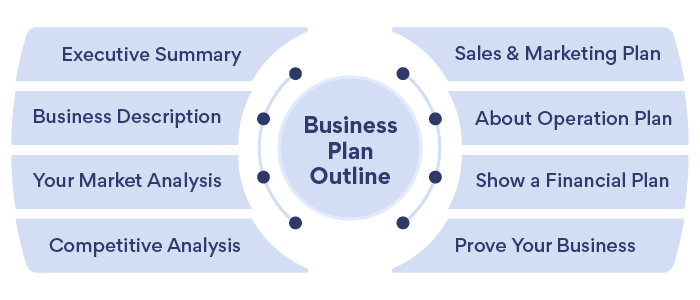

What is a Business Plan Outline?

A business plan outline is a framework that helps you cover the essential information around your business idea. Your outline helps define the results of your market analysis, competitor analysis, the products, and services you plan to offer, and a lot more.

The outline also helps you plan out the best ways to present your idea and to-be-used resources in front of the investors. Briefly, a business plan outline enables you to present your ideas convincingly.

Why Write a Business Plan Outline?

The most effective way to convince any investor about your business idea is to help them get answers to these three critical questions:

- What does your business stand for?

- What makes your idea unique compared to competitors?

- What is in it for them?

Your business plan can help you answer these questions.

If you fail to outline your plan the right way, investors may lose interest halfway or even in the beginning as they read through your documented business plan.

To avoid such adverse reactions, it is important that you create an outline first and then add your researched information in that format to better present your idea to investors.

How to Write a Business Plan Outline?

Now that it is clear why an outline is crucial to writing a business plan, it is time we see what all it should cover. Most experts online will encourage you to start with a table of contents or an index. But you can skip this step if you are using a knowledge base.

With Knowledge base software, you can display a table of contents throughout the plan. They can access any point in question at any time. Except, if you are not planning to make your outline virtually using an internal knowledge base solution, it is advised to create an index first.

An index will help you list all the pointers you aim to cover in your business plan. It makes it easier for investors to go back and refer to the data they’ve already read during the review process.

Create an Engaging Executive Summary

First impressions are lasting impressions

No one wishes to take this expression lightly. But here is a fact: there is no way investors will continue reading your business plan if it fails to create an impact that encourages them to read the plan further.

Your executive summary is a critical factor for investors to decide if your project is worth financing or not.

What is an executive summary?

The executive summary is mostly written once you are done writing your entire plan. That’s because it summarizes and offers an introduction to your plan.

Here’s a list of questions your executive summary must answer:

- Who is your target audience?

- What do you plan to sell?

- How will your offerings evolve over time?

- How much should investors expect to gain post-financing your business?

- What is the initial investment you seek to get your business started?

With these questions answered, it will be easier for investors to read through the entire plan.

Describe Your Business with a Detailed Description

The business plan is incomplete without its detailed description. Consider this part of the plan as an “about us” section. You need to explain what your business is and why you decided to take up the project. The more detailed it gets the better.

However, it is recommended that you cover sections like:

- Company background & history: Explain what factors compelled you to start this business. Also, explore when you thought of this idea and what was the source of its inspiration.

- Structure & ownership: Let your investors learn about other shareholders who plan to help you gain the necessary resources to build the planned product or service. You should also share details about business registration. Let investors know where your company is registered and if you have any legal structure in place. This will help them check your eligibility as a potential business investment.

- Location: Help investors know where you plan to open the office. Make sure to include a map that helps them understand where the location is and what could be the possible expenses to get the needed resources to the location.

- Experience: We are not just hinting about your experience and credibility in the market. You also need to stress the experience of those who will help you execute your plan. Let the investors understand that you are backed by experienced individuals in the sector. Also, do not hesitate to share skill gap-related concerns. The sooner they are tackled the better.

- Initiatives & cause: If there is any initiative you wish to support through your business, let your investors learn about it fast. You must stand by a cause that you wish to donate to or support through your business. While this will help you build a positive impression on investors, it is good for branding as well.

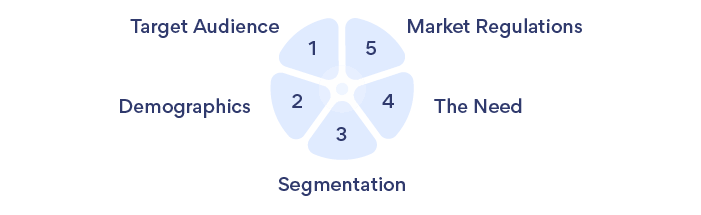

Bring Together Your Market Analysis

Market analysis is quite complex. You need to figure out and confirm a lot of factors before you settle on a business plan. To help you get started with the outline of your market analysis section, we’ve listed a few points below.

- Target audience: This is no doubt the first aspect that investors would be interested in learning about. Therefore, it would be a great idea to discuss your target audience first when you start with the market analysis section. As you explain the target audience, make sure you explain why you aim to target them and how will this audience benefit from your offerings.

- Demographics: Share details around the specific demographic you wish to target. These details can be inclusive of age group, location, gender, and more. With a detailed insight into the demographics, they can confirm if you are going to target the right audience or not.

- Segmentation: Once done describing the details on demographics, it will be easier for you to explain which segment you plan to target. You can also segment this audience further into groups of potential buyers and those who will bring in more value to your sales.

- The Need: Explain how your products and services will match the growing need of the customers. You also need to explain the possible reasons that encourage customers to make the purchase and if it is something that they will need regularly.

- Market Regulations: Another factor that will need to be discussed at length is market regulation. If you identify which market regulation applies to your business, it will be easier for investors to understand the possible ways you will comply with them.

Identify Your Market Competitors with a Competitive Analysis

Let investors know that you are not behind your competitive analysis. This section will be a terrific way to introduce your direct and indirect competitors. Elaborate about their strengths, weaknesses, and the USP that helps them stand out in the market.

Other than these crucial factors, you should not miss answering questions like:

- Who is this competitor? (Name, brand visibility, and where they are located)

- How big is this competitor? (Number of employees, rough customer count, and more)

- Who is their target audience? (Demographics and segmentation)

- What do they offer? (Discuss unique characteristics, services, products, pricing, and more)

With this detailed outline, you can give a stand on how your brand will be positioned in the market. Concisely, it will help you show investors how different you are from the competitors.

Build an Actionable Sales & Marketing Plan

This is a dedicated section to display your numbers. From product pricing to every promotional activity, you plan to undertake, all need to be a part of this section. You also need to highlight the unique selling point of your product as it will be a part of your marketing plan. On top of these top selling points, here is a list of things you can add.

- Milestones: It would be a good start if you show investors the goals you plan to achieve. Remember that if they are relevant, achievable, and measurable according to the resources you plan to locate in the business process, the easier it will be to convince investors of your business.

- Risks & Mitigations: This is yet another pointer you cannot miss when building the outline for a sales and marketing plan. Both you and the investors can anticipate risks or roadblocks you may face while bringing the business plan to life.While you do share the possible risks your business might get subjected to in the future, make sure to identify the best ways to overcome them. This will help you increase the investor’s confidence in your idea and foresight.

- Marketing plan: USP is indeed a crucial aspect of any marketing plan. However, that is not the only thing you need to focus on when trying to reach out to your audience.Marketing is about the reach you have once you start as a brand. It is also about identifying the best channels to help you reach as many potential customers as possible.

You also need to show what your competitors are doing as they take a step forward to become a brand. More importantly, you need to decide the marketing initiatives and their stakeholders who will help you implement them successfully.

- Profits: Predicting your sales target is important for any investor. By predicting how many sales you make in a week, month or quarter, investors can get an idea of when you will start making profits. To predict profits, you need to arrive at the right pricing that gives you a competitive edge over others while being rational about it.

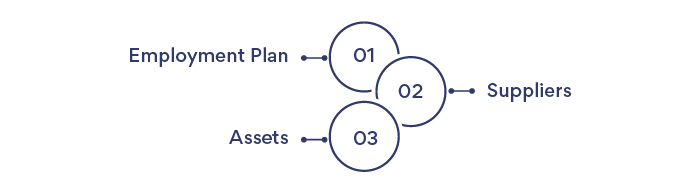

Inform Investors About Operations Plan

In this part of the business plan outline, you need to help investors understand how your organization is planning to function. Here is what you need to include in this section.

- Employment plan: Share your employment plan that is divided into phases. Let investors know how many people you plan to hire in the first phase of your business. Initially, you cannot go all out. Decide task priorities and the resources needed to build a base for your business. Also, highlight the possibility of increasing the workforce as your business grows.

- Suppliers: Let us not forget the suppliers in the operation plan. Give details about the suppliers you plan to work with. Investors can check if the suppliers are reliable sources or not.

- Assets: It is also important that you inform investors about the assets you plan to use or are crucial for the functioning of your business. Be specific about these assets and explain how they will play a role in the development of your products and services. On top of that, explain how you aim to protect assets or intellectual property that streamlines the functioning of the business.

Show a Realistic Financial Plan

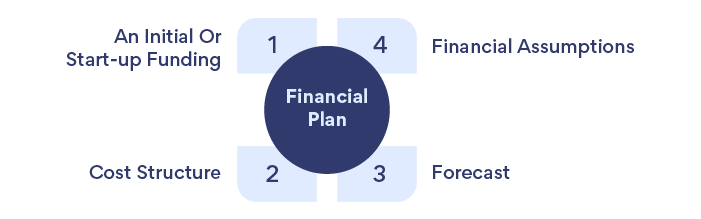

A financial plan plays a crucial role in the decision-making process. Investors need to understand how you plan to allocate the capital received. As you give a bifurcation of the capital in the financial plan, here is a list of things you can start focusing on.

- An Initial/Start-up funding: The first thing you need to cover in this outline is the initial funding you will require to give your business a kick-start. Explain the fund’s allocation and how shareholders may benefit from this initial funding.

- Cost Structure: Your cost structure needs to identify operational risks that a business may potentially face. You can use both breakeven and operating leverage that will allow investors to evaluate operational risks hassle-free.

- Financial Assumptions: Let us not take investors’ assumptions about your financial plan lightly. If you are proposing a business plan for starting your app, the development cost may keep as you grow the app. However, this assumption may not be true in the case of all app-based business ideas.Make sure you identify the assumptions around the revenue you may earn and the cost of implementation. By doing this, you can clarify a lot of doubts that investors may have about the funds you may require to keep the business running.

- Forecast: Another important aspect of your financial plan is to bring the sales forecast to light. You need to include all the key aspects of your business plan outline like competitor analysis, marketing strategy, sales plan, and more.These crucial factors will help investors understand why you are projecting a certain number for sales and profit in the plan. You can share a forecast for the next three to five years with them.

Prove Why Your Business is a Credible Investment

This is a popular section that goes by the name ‘Appendix.’ This section is your savior. There are a lot of things that you cannot add to other sections of the plan.

But no worries, Appendix is one section where you can add the additional details of your plan to make sure you have not left anything out from your research. You can share additional information like office layout plans, stakeholder agreements, credit histories, and more.

Build a Complete Business Plan Outline Now!

Creating your business plan outline can be confusing, especially if you are making one for the first time. Sadly, a lot of business ideas get rejected by investors because they fail to deliver the right message, or they feel lacking in presentation.

But fret not. Our business plan outline will allow you to bring your idea to life. This detailed and well-structured approach helps you expand on your business values, what you know about the market and your competitors, and more. That is not all.

You can even find ways to add all the additional information you have found during the research and ideation process that helps investors arrive at the right decision.

Concisely, it will work as a guide that will help investors know your idea better and assist your team to align with your direction of work.